FINDING SOLUTIONS FOR YOU

News:

20/04/11 UK Banks lose Payment Protection Insurance challenge in High Court.

05/12/11 HSBC fined £10.5m by FSA for mis-selling care funding to the elderly.

14/12/11 FSA makes deposit insurance disclosure mandatory

08/03/12 Groundbreaking Consumer Insurance (Disclosure and Representations) Act receives Royal assent.

26/06/12 Law Commission launches consultation on 'Insurance Contract Law' reform for business

12/09/12 Michael Jackson £10.9m insurance claim against Lloyds dropped

01-04-13 Financial Conduct Authority established

01-14 Ombudsman upholds more than 1000 buildings insurance complaints

FIRE FLOOD & WATER DAMAGE

Our Mission

Our mission is to assist parties who are experiencing difficulties with their insurance claims to resolve their disputes.

We have already helped many parties resolve disputes whether through under insurance, claims rejection, poor administration or lack of understanding.

Indeed we have a panel of experts, lawyers, engineers and surveyors in the UK and overseas who are available to assist you.

2013 & 2014 Flooding

The Winter of 2013 2014 has witnessed the worst flooding on record in many parts of the United Kingdom from the Somerset Levels to the Thames Valley and Norfolk Coast. Each case brings its own story of grief, family and business upheaval and need for timely solution focused remedies.

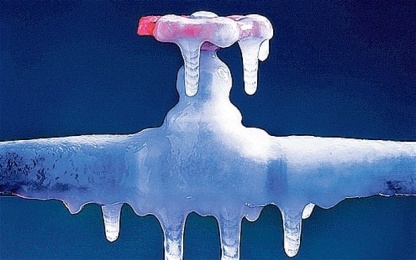

Fires & Burst Pipes

Top causes of house fires include cooking equipment, heating equipment, electrical equipment, inadequate wiring, careless smoking, candles, barbecues and burst pipes. Sources of heat in close proximity to combustibles can be a highly flammable mix. Inadequate insulation may also cause pipes to freeze and burst in the depths of winter.

Under Insurance

Under insurance occurs when the sum insured does not reflect the size of the risk or capital asset insured for instance the home. In such circumstances insurers will typically assess claims on a pro rata percentage basis. There are however mechanisms in place for seeking full recovery and we have assisted many in such situations.

Rejected Insurance Claims

Claims may be rejected when the insurance policy does not correspond with the contractual insurance risk. A home owner for instance must notify an insurer when a home is let rather than occupied by the home owner. Often there may have been a breakdown in communication when the insurance was set up. If so there are a number of remedies. We have assisted many in similar situations.

At Insurance Claim Solver we have more than 25 years experience of successfully resolving insurance claims, even those that have previously been turned down.

Testimonials

Here is what our customers have to say:

‘When all had seemed lost Insurance Claim Solver recovered more than £80,000 for me. Excellent Service’

AF Southampton

‘Highly proficient and efficient. A fantastic service. Insurance Claim Solver managed to settle my claim in 2 weeks. Before that I had struggled for a whole year with insurers who constantly turned a blind eye. I even recovered far more than I imagined. I would highly recommend them. I will certainly use them again’

PC Oxford

Let Us Help You

- London

- Southampton

- Banbury

- Watford

Your Path to Success

E: resolve@insuranceclaimsolver.co.uk